Work From Home Stipend Calculator

Use this calculator to determine how much you should offer employees as a work-from-home (WFH) stipend. With a few quick inputs, the calculator will show you a monthly or annual WFH stipend recommendation per employee—and the total cost to your company.

Part-Time vs Full-Time Cost-Effectiveness Comparison

Full-Time Employees

Part-Time Employees

Cost-Effectiveness per Employee (Weekly)

Full-Time: per productive hour

Part-Time: per productive hour

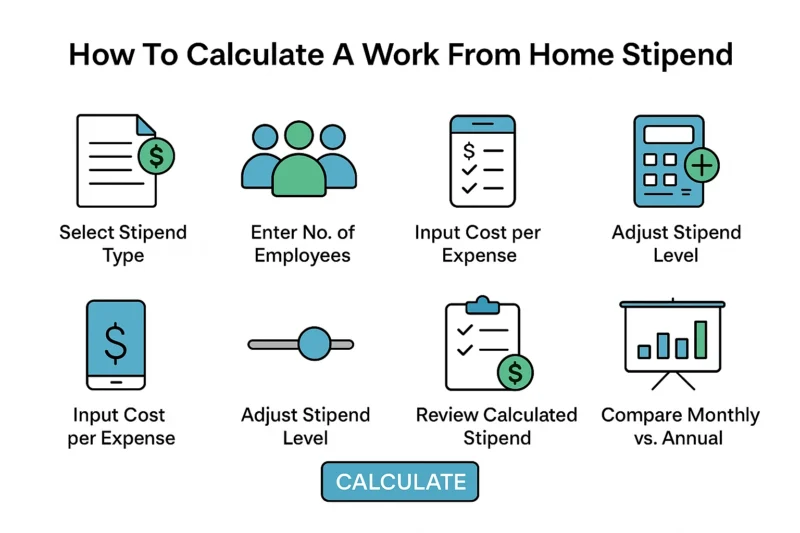

How To Calculate A Work From Home Stipend

Work From Home Stipend Definition

A work-from-home stipend is a recurring or one-time payment provided to remote employees to cover expenses incurred while working from home.

This could include reimbursement for internet, equipment, office furniture, utilities, and other remote work-related expenses.

Work From Home Stipend Calculation

WFH Stipend = (Suggested stipend per employee) × (Number of employees)

The calculator helps you estimate a reasonable per-employee stipend based on your inputs, and projects the total cost to your company across your workforce.

Instructions For The Work From Home Stipend Calculator

Follow these steps to calculate a suggested monthly or annual work-from-home stipend for your employees:

- Select your stipend type: Choose whether you want to calculate a monthly or annual stipend.

- Number of remote employees: Input how many employees are eligible to receive the stipend.

- Choose which expenses to include: Check the boxes for any of the common remote work expenses you'd like to cover—such as internet, phone, coworking, utilities, equipment, and office furniture.

- Enter the monthly cost of each selected item: For each checked item, input your estimated monthly cost per employee. This will help tailor your stipend to your team's actual needs.

- Adjust stipend level: Use the stipend percentage slider to increase or decrease your reimbursement coverage (0–100%).

- Include a buffer (optional): Add a cost buffer (default 10%) to account for future price increases or additional small costs.

- Review your calculated stipend: The calculator will display the suggested stipend amount per employee and the total cost across all remote workers, based on your inputs.

- Compare monthly and annual options: Toggle between monthly and annual views to help with budgeting and policy planning.

- Download or document your results: Use the output to guide your HR or finance team when creating or adjusting your remote work stipend policy.

- Hit "Calculate" to view results: Your customized stipend recommendations will appear in the green results box below.

- Scroll down to see your customized stipend recommendation in the results box.

Uses For The Calculator

Why Offer a Work From Home Stipend

Offset Remote Work Costs: Help employees cover essential expenses like high-speed internet, equipment, or additional utilities used when working from home.

Improve Remote Work Experience: Providing a stipend shows support for employees’ remote setup, which can improve comfort, productivity, and morale.

Attract & Retain Talent: Stipends are a competitive benefit that can differentiate your company when hiring and reduce turnover among current remote employees.

Tax Compliance: Standardizing your stipend amount can help ensure you're handling reimbursements consistently and fairly across the company.

Budget Planning: Use this calculator to understand the financial impact of offering stipends across different teams, departments, or the entire organization.

Related Resources For Remote Work Cost Savings

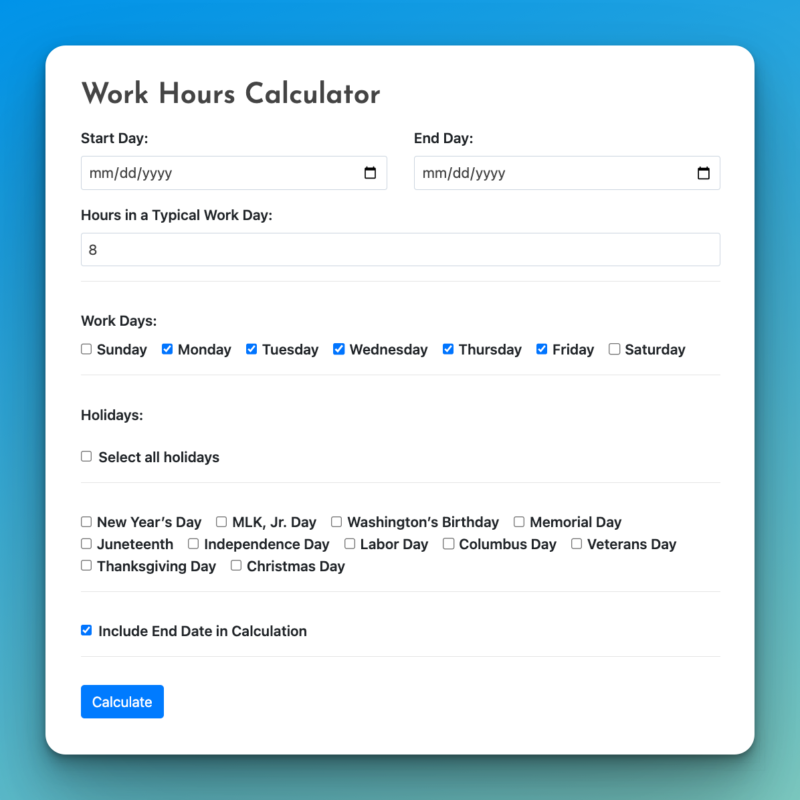

Work Hours Calculator

If you want to quickly calculate work hours over any time period, use this calculator.

Other Work Calculators

Here are a few other free calculators we've built:

Disclaimer: This calculator is for estimation purposes only. Please consult with your finance or HR team to assess savings specific to your organization, location, and other factors.