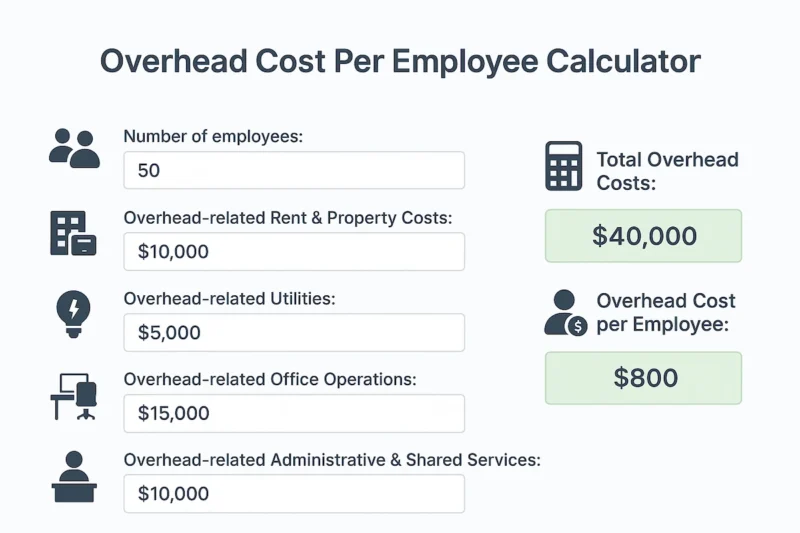

Overhead Cost Per Employee Calculator

Use this calculator to determine your average overhead cost per employee. With a few simple inputs, it will calculate the portion of rent, utilities, office operations, and administrative costs attributable to overhead, divided by the number of employees.

Overhead Cost Per Employee Calculator

Monthly Overhead Costs (Overhead Portion Only)

Total Overhead Cost:

$

Overhead Cost per Employee:

$

How To Calculate Overhead Cost Per Employee

Overhead Cost Per Employee Definition

Overhead cost per employee is the average share of indirect business expenses allocated to each employee. These are costs not directly tied to producing goods or services, but necessary to keep the business running — such as rent, utilities, administrative salaries, and office operations.

Overhead Cost Per Employee Formula

Overhead Cost Per Employee = Total Overhead Costs ÷ Number of Employees

For this calculator, “Total Overhead Costs” is the sum of the following categories (overhead portion only):

- Office Space Costs (Overhead Portion Only) – The share of rent/lease costs related to overhead, excluding production or direct billable areas.

- Utilities & Facilities (Overhead Portion Only) – The sum of electricity, water/sewer, heating/cooling, internet, and phone costs attributable to overhead.

- Office Operations (Overhead Portion Only) – Supplies, maintenance, cleaning, and security costs for overhead areas.

- Administrative & Shared Services (Overhead Portion Only) – HR, payroll, shared software, and other admin-related overhead costs.

Instructions For The Overhead Cost Per Employee Calculator

Follow these steps to calculate your overhead cost per employee:

- Office Space Costs (Overhead Portion Only): Enter the share of rent or lease costs used for overhead purposes only — do not include space dedicated to production or client work.

- Utilities & Facilities (Overhead Portion Only): Enter the total overhead portion for electricity, water/sewer, heating/cooling, internet, and phone bills.

- Office Operations (Overhead Portion Only): Enter the total costs for supplies, maintenance, cleaning, and security related to overhead areas.

- Administrative & Shared Services (Overhead Portion Only): Enter the total overhead share for HR, payroll, shared software subscriptions, and general admin costs.

- Number of Employees: Enter the total number of employees to which these costs will be allocated.

Hit “Calculate” to see your overhead cost per employee.

Scroll down to view the results in the results box just below the calculator.

Uses For The Calculator

- Budgeting: Helps in allocating resources and setting cost-control measures.

- Pricing Strategy: Ensures product or service pricing covers overhead costs.

- Profitability Analysis: Reveals how much each employee’s overhead contributes to total expenses.

- Operational Efficiency: Identifies opportunities to reduce unnecessary overhead.

- Planning & Forecasting: Assists in long-term business planning by tracking overhead trends.

Disclaimer: This calculator is for informational purposes only. Consult with your finance or accounting team to ensure you’re using the correct overhead allocation method for your business.