Why Are Companies Going Back To The Office?

The data shows that people want to work from home.

Pew researchers found (in a 2022 survey of 10,237 U.S. adults) that…

- 60% of workers with jobs that can be done from home say they’d like to work from home all or most of the time when the pandemic is over.

- Among those who have a workplace outside of their home, 61% now say they are choosing not to go into their workplace, while 38% say they’re working from home because their workplace is closed.

Companies are still pushing a return to office (but failing).

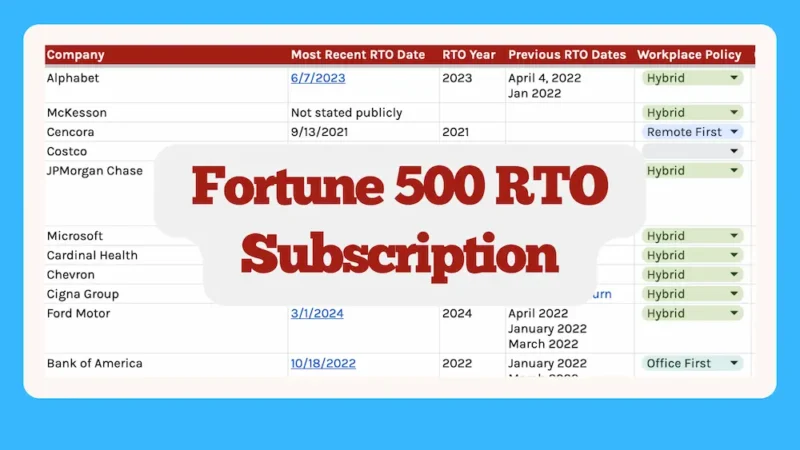

Kastle System’s “back-to-work barometer” shows across its top 10 US cities that office occupancy has settled in at just 50%.

In other words, if two people came into the office in 2019 (before Covid), now just one person comes in.

Here at Buildremote, we reported in March of 2022 that only 3 of the Fortune 100 had declared a full return to the office for all employees.

To summarize…

People want to work from home but companies are still pushing for a return to the office. So… why are companies returning to the office at all?

So, why are some companies going back to the office? Incentives.

Charlie Munger said, “Show me the incentive and I’ll show you the outcome.”

It’s not that they are more efficient or have happier employees or a better company culture in the office. Here are the incentives that are pushing management teams to return to the office.

1. Companies Have Leases

Commercial leases typically run from one to 10 years and big office spaces could run much longer. Therefore, most companies currently have multiple years left on their leases in which they’ve committed to pay for years of space.

Leaders who are pushing for a return to office are suffering from sunk-cost fallacy where they continue a behavior as a result of previously invested resources.

- If you have 10 years left on your lease and tons of money tied up in office space, then you think the office is best.

- If your lease luckily ran out during COVID, then you likely reduced your office space or got rid of it altogether to go fully remote.

2. Companies Own Their Buildings

Some companies own their buildings which would come with all of the sunk cost biases that companies face with lease.

However, there is an additional incentive here. Companies view their office space (real estate) as a valuable, appreciating asset for the company. If they choose to go fully remote, they are admitting that their asset is experiencing impairment during a time when office space could drop significantly in value.

That’s hard to admit to yourself as a management team, so companies would rather return to the office to prop up its value than admit its asset has become a liability.

3. Companies Have Outdated Operating Systems

If your management team relied on physically seeing people at desks as a way to measure success, then remote work was a significantly worse experience for your company.

These companies don’t actually manage the output or value brought by employees at their companies. They just manage on feel, in-person status reports, and time-at-desk. Those do not correlate to success for the business, but it’s a common way to operate.

If that’s how you operated as a company, switching to remote work in 2020 must have been a disaster. No longer do managers feel useful or know what people are doing. This was never a good way to operate, but remote work made it seem worse. Therefore, you’d blame remote work for shortcomings that were already there.

4. Your Company’s Income Is Tied To Commercial Real Estate

I noticed a trend with banks in my return to office research. All of the banks in the Fortune 100 have returned to the office in some capacity – hybrid or full. Why?

Think about it. The banks lend to companies that own commercial real estate. If they were to admit to themselves that the office is no longer helpful, they’d be admitting that billions of dollars they’ve underwritten are worthless. They are incentivized to say that office space is still valuable, so they return to it.

Remote work is not an option when you make money from commercial real estate.

What will happen to the office from here?

Most companies will attempt a hybrid work model like Google has so far, but that will lose steam. It’s the worst of both worlds.

- You are still stuck hiring locally (within driving distance), so your talent pool is greatly reduced

- At any given time, you have staff working from home so you have to default to Zoom meetings (ie. remote work from the office)

- You’re still paying for your second biggest expense (office space) when it could go away completely

- Your employees still have to face a commute multiple times per week only to work virtually once they arrive

Next, smart companies will go fully remote.

- They’ll hire talent anywhere and end up with a superior team, potentially for less cost

- They’ll cut the cost of office space and be able to use the budget elsewhere

- They’ll have happier employees

Remote companies will beat out hybrid companies (which already beat out fully in-office companies).

Then we reach the complete turning of the remote work revolution. Every job that can be done virtually will be done that way. The cost of office space will crater. Cities that adapt will attract remote workers, but ones that don’t will die. Middle managers (the ones that sit in offices and watch people work) will go away as asynchronous companies with great remote operating systems will make them obsolete.

Then, the majority of people who said they want to work from home forever will get their wish while companies take a leap forward in efficiency and employee happiness.

See Also: 28 Remote Work Incentive Programs

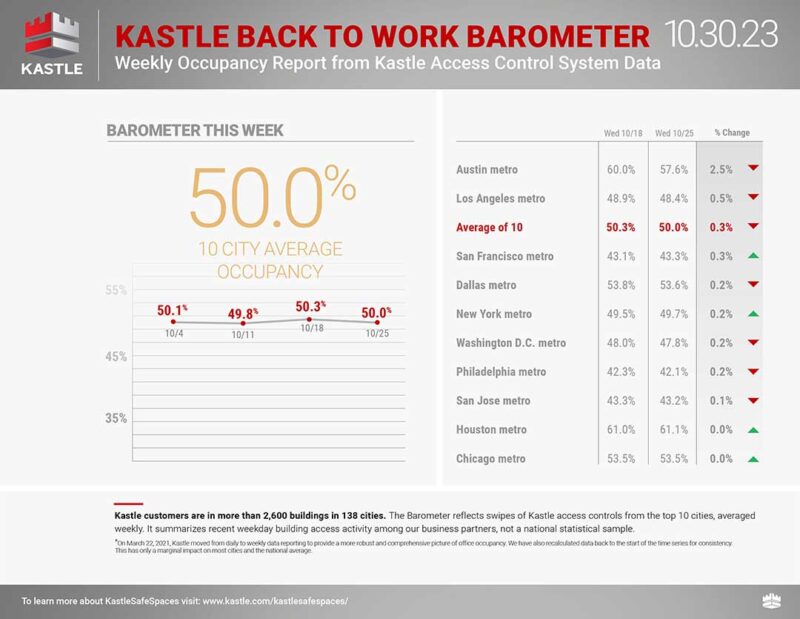

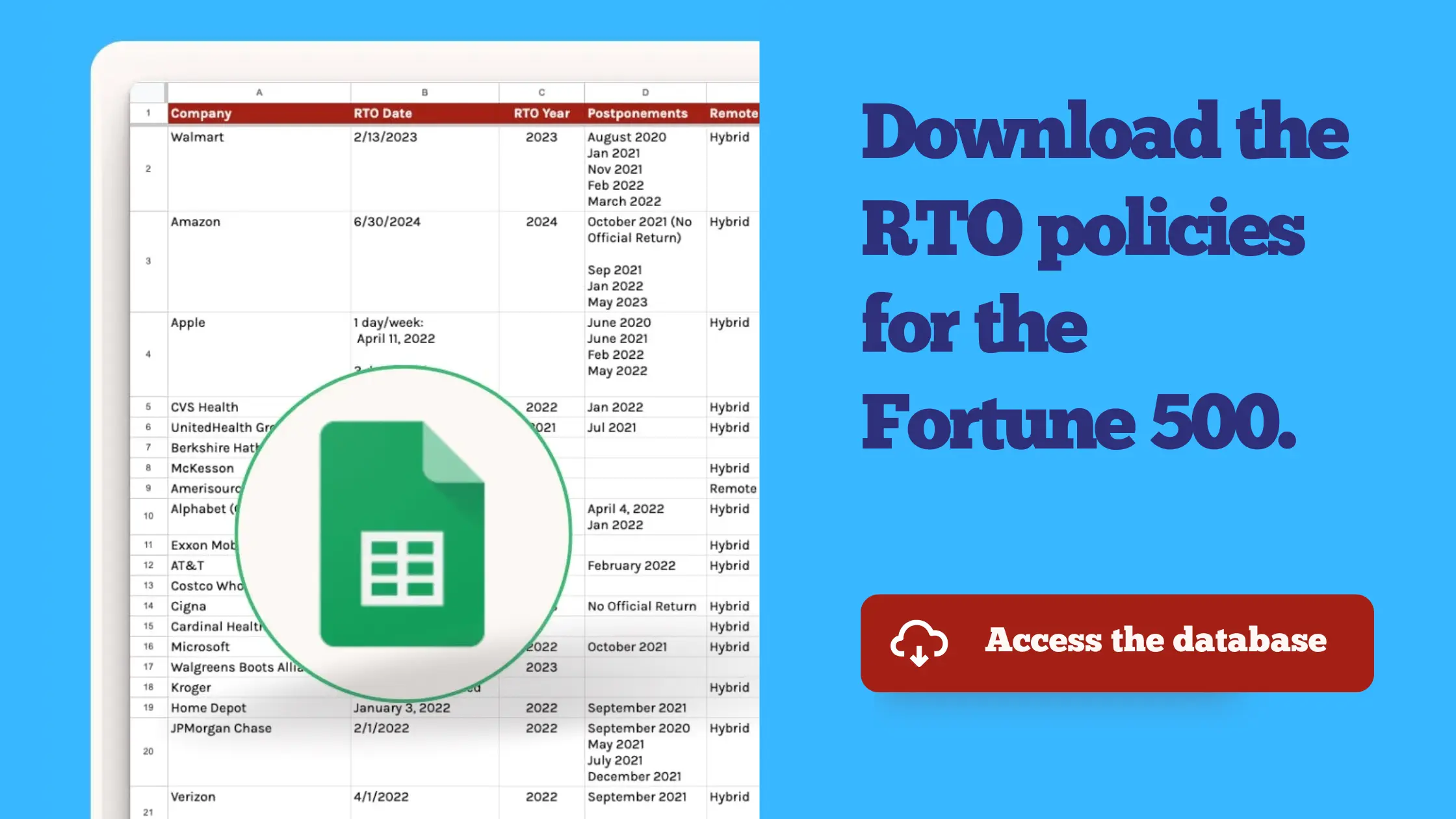

View All Return To Office Plans For The Fortune 500

Every month, we update every Fortune 500 company’s return-to-office policy. You can download the Fortune 500 RTO spreadsheet below.

RTO news & sentiment by company: Alphabet (Google), Amazon, Apple, Bank Of America, Goldman Sachs, JP Morgan Chase, Meta (Facebook), Microsoft, Morgan Stanley, Wells Fargo |